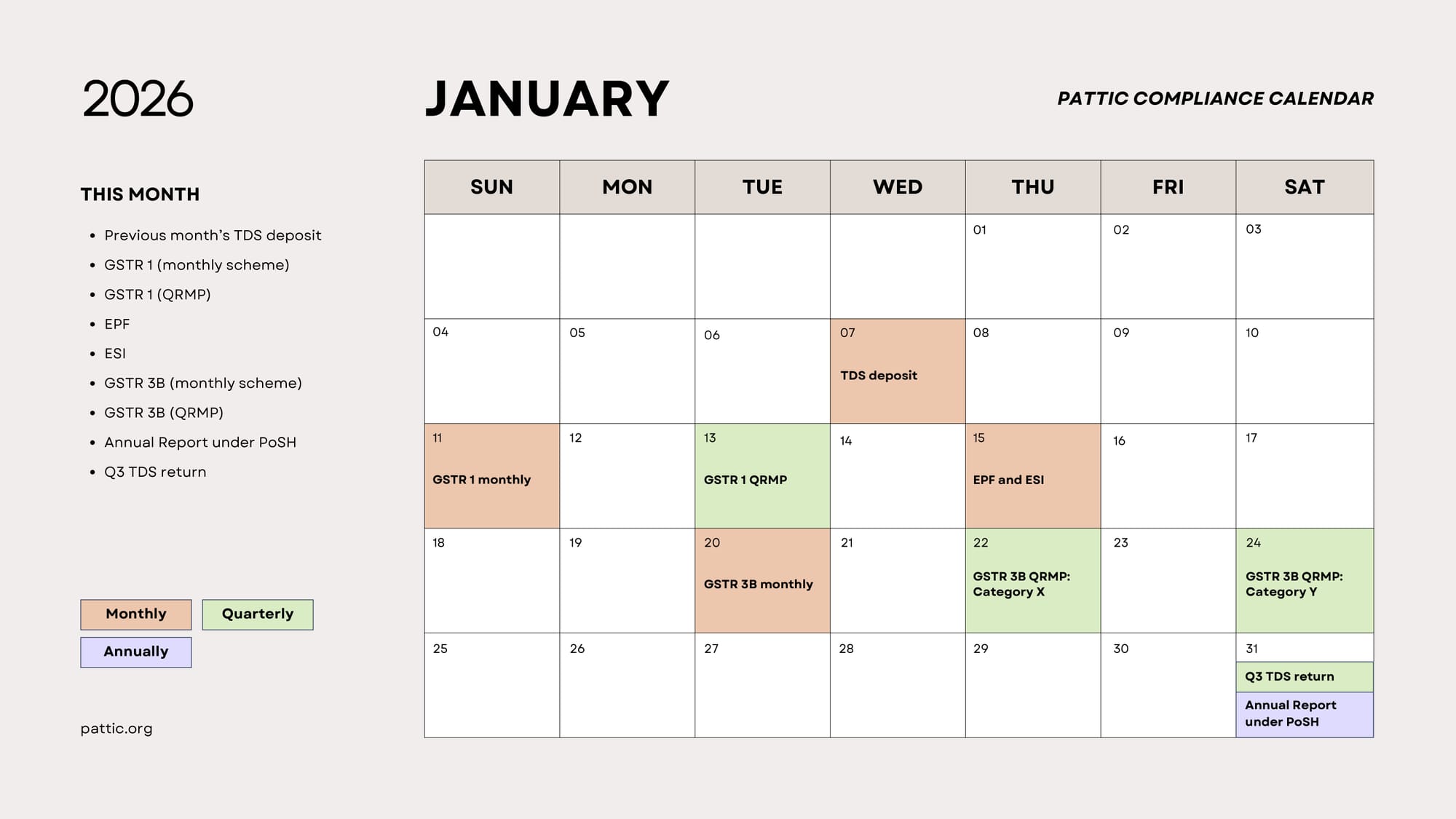

January is a good month to set a calm, steady compliance rhythm for the year. Here’s PATTIC’s quick compliance calendar for January 2026.

Direct Tax / TDS

7 January — Previous month’s TDS deposit

31 January — Q3 TDS return

GST

11 January — GSTR-1 (Monthly scheme)

13 January — GSTR-1 (QRMP)

20 January — GSTR-3B (Monthly scheme)

22 January — GSTR-3B (QRMP — Category X states)

24 January — GSTR-3B (QRMP — Category Y states)

Labour / Social Security

15 January — EPF and ESI contributions

31 January — Form VI (Contract Labour)

Workplace Compliance

31 January — PoSH Annual Report

Save this email, share it with your Finance/HR/Admin teams, and plan internal cut-offs a few days early to avoid last-minute stress.

Hope this helps you stay on track this month!

- Team PATTIC